If you turn 18 this year, you are younger than Amazon and Google. You turned three with Facebook’s arrival, four with YouTube, five with Spotify, six with the iPhone and eight with WhatsApp.

If you are at the upper end of the 18-30 age range, you will remember a time before mobile internet, but not a time before mobile phones. If you are anywhere in that range, you use your mobile to read, chat and play, stream music and videos, hail taxis, order food, and search for dates and jobs.

You use mobile phones to manage your money, too. Research last year by Raddon, a consultancy, found that 85% of American millennials (those born between 1981 and 1996) used mobile banking, and predicts that the share will be higher still for Gen Z(born after 1996). The main reason people choose a bank is convenience, the consultancy says. For older people that means a nearby branch; for younger ones it means an excellent app.

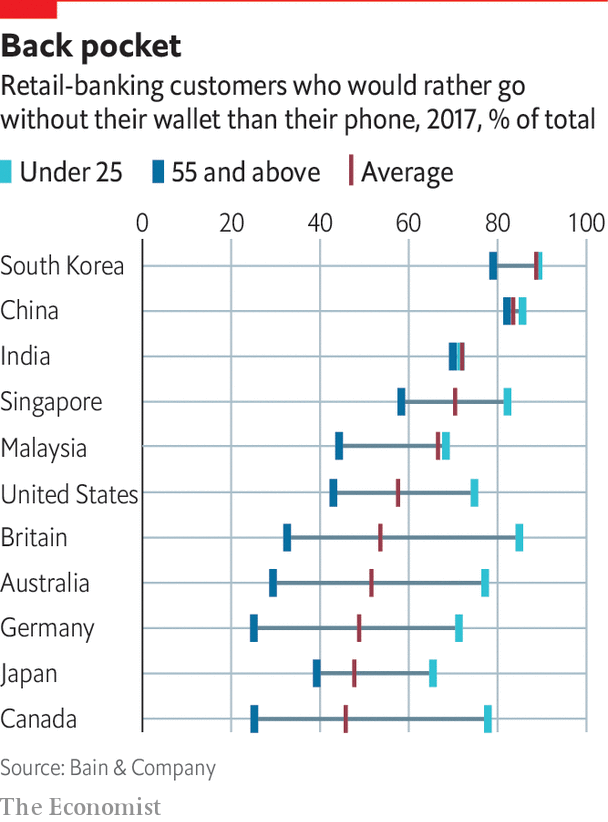

In 2017 Bain & Company, another consultancy, asked people in 17 countries which they would miss more for a day: their phone or their wallet. Everywhere except Japan and Malaysia, the share of under-25s who would miss their phone more was above 70% (see chart).

According to bankrate.com, a comparison service, just one in three American millennials has a credit or debit card, a much lower share than for previous generations at the same age. All this means banks find it hard to make money from you.

You also demand more from financial institutions than older people do, and care more about corporate social responsibility. The young think bankers should care about helping people to become wealthier, not just about their own bottom line.

From The Economist (edited)